Numida is Utilizing Data to Improve Small Businesses in Africa

The estimated 450,000 micro, small and medium enterprises (MSMEs) generate 90% of private sector production and create 4 out of 5 new jobs in Uganda.

When these businesses thrive, the local economy flourishes and the standard of living improves. Without financing, however, their operations are severely limited.

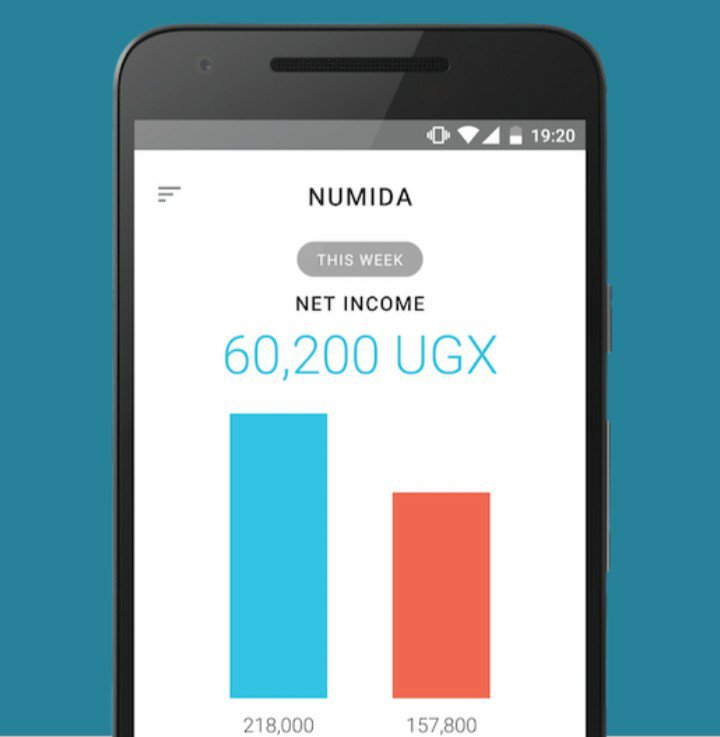

In providing a lasting solution to this difficulty, Catherine Denis, Ben Best and Mina Shahid co-founded Numida in 2015 to help small businesses easily digitize their financial records.

With these records and Numida’s in-app coaching, entrepreneurs are equipped to make better business decisions in order to maximize profit, reduce expenses and manage expenses among other things.

In this way, Numida helps small business owners ditch pen and paper and start keeping current, digital financial records that clearly show how their business is performing.

Numida is supporting entrepreneurs who have outgrown microfinance so that their businesses can reach its full potential. They are using historical behavior and business performance to advise entrepreneurs in real-time, how to grow their businesses.

The startup is changing the way African businesses access credit by using their data to predicts risk and offer convenient and fair credit.

With automated analysis and coaching built into Numida and their customer support team available for guidance, small business owners have the tools to make informed decisions about their future.

As small business owners continue to update their finances in Numida, they build their financial track record, allowing them to access cheaper, faster and better credit through their phone.

According to Kayemba, a Numida user since 2016 “I use Numida because I want to be organized. Numida has been very useful as it tells me how I am proceeding – profit or loss”

The startup is presently focused on Uganda, but they are open to providing services to the 22 million MSMEs across sub-Saharan Africa who need credit, as this represents a $130 billion credit opportunity.